2 months ago TIBCO (Symbol TIBX on NASDAQ) announced Spotfire 6 at TUCON 2013 user conference. This as well a follow-up release (around 12/7/13) of Spotfire Cloud supposed to be good for TIBX prices. Instead since then TIBX lost more then 8%, while NASDAQ as whole grew more then 5%:

For example, at TUCON 2013 TIBCO’s CEO re-declared “5 primary forces for 21st century“(IMHO all 5 “drivers” sounds to me like obsolete IBM-ish Sales pitches) – I guess to underscore the relevance of TIBCO’s strategy and products to 21st century:

-

Explosion of data (sounds like Sun rises in the East);

-

Rise of mobility (any kid with smartphone will say the same);

-

Emergence of Platforms (not sure if this a good pitch, at least it was not clear from TIBCO’s presentation);

-

Emergence of Asian Economies (what else you expect? This is the side effect of the greedy offshoring for more then decade);

-

Math trumping Science (Mr. Ranadive and various other TUCON speakers kept repeating this mantra, showing that they think that statistics and “math” are the same thing and they do not know how valuable science can be. I personally think that recycling this pitch is dangerous for TIBCO sales and I suggest to replace this statement with something more appealing and more mature).

Somehow TUCON 2013 propaganda and introduction of new and more capable version 6 of Spotfire and Spotfire Cloud did not help TIBCO’s stock. For example In trading on Thursday, 12/12/13 the shares of TIBCO Software, Inc. (NASD: TIBX) crossed below their 200 day moving average of $22.86, changing hands as low as $22.39 per share while Market Capitalization was oscillating around $3.9B, basically the same as the capitalization of 3 times smaller (in terms of employees) competitor Tableau Software.

As I said above, just a few days before this low TIBX price, on 12/7/13, as promised on TUCON 2013, TIBCO launched Spotfire Cloud and published licensing and pricing for it.

Most disappointing news is that in reality TIBCO withdrew itself from the competition for mindshare with Tableau Public (more then 100 millions of users, more then 40000 active publishers and Visualization Authors with Tableau Public Profile), because TIBCO no longer offers free annual evaluations. In addition, new Spotfire Cloud Personal service ($300/year, 100GB storage, 1 business author seat) became less useful under new license since its Desktop Client has limited connectivity to local data and can upload only local DXP files.

The 2nd Cloud option called Spotfire Cloud Work Group ($2000/year, 250GB storage, 1 business author/1 analyst/5 consumer seats) and gives to one author almost complete TIBCO Spotfire Analyst with ability to read 17 different types of local files (dxp, stdf, sbdf, sfs, xls, xlsx, xlsm, xlsb, csv, txt, mdb, mde, accdb, accde, sas7bdat,udl, log, shp), connectivity to standard Data Sources (ODBC, OleDb, Oracle, Microsoft SQL Server Compact Data Provider 4.0, .NET Data Provider for Teradata, ADS Composite Information Server Connection, Microsoft SQL Server (including Analysis Services), Teradata and TIBCO Spotfire Maps. It also enables author to do predictive analytics, forecasting, and local R language scripting).

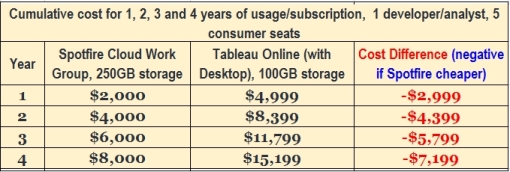

This 2nd Spotfire’s Cloud option does not reduce Spotfire chances to compete with Tableau Online, which costs 4 times less ($500/year). However (thanks to 2 Blog Visitors – both with name Steve – for help), you cannot use Tableau online without licensed version of Tableau Desktop ($1999 perpetual non-expiring desktop license with 1st year maintenance included and each following year 20% $400 per year maintenance) and Online License (additional $500/year for access to the same site, but extra storage will not be added to that site!) for each consumer. Let’s compare Spotfire Workgroup Edition and Tableau Online cumulative cost for 1, 2, 3 and 4 years for 1 developer/analyst and 5 consumer seats :

Cumulative cost for 1, 2, 3 and 4 years of usage/subscription, 1 developer/analyst and 5 consumer seats: |

|||

Year |

Spotfire Cloud Work Group, 250GB storage |

Tableau Online (with Desktop), 100GB storage |

Cost Difference (negative if Spotfire cheaper) |

1 |

$2000 |

$4999 |

-$2999 |

2 |

$4000 |

$8399 |

-$4399 |

3 |

$6000 |

$11799 |

-$5799 |

4 |

$8000 |

$15199 |

–$7199 |

UPDATE: You may need to consider some other properties, like available storage and number of users who can consume/review visualizations, published in cloud. In sample above:

- Spotfire giving to Work Group total 250 GB storage, while Tableau giving total 100 GB to the site. 2 or more subscriptions can be associated with the same site, but it will not increase the size of storage for the site from 100 GB to more (e.g. 200 GB for 2 subscribers).

- Spotfire costs less than Tableau Online for similar configuration (almost twice less!)

December 17, 2013 at 10:39 pm

Thanks Andrei. Thought provoking post as usual.

But I am not sure I agree with your comment ” This 2nd Spotfire’s cloud option reduces Spotfire chances to compete with Tableau Online, which costs 4 times less ($500/year).” Spotfire Workgroup does have 5 consumer licences, that are somewhat close to a Tableau Server online licence. So as I see it, the costs are fairly similar.

Rather than pricing, I think the core problem with Spotfire 6 Cloud is

1) Spotfire Enterprise cloud’s entry point price is way too high. I have been advised by Spotfire that it requires a $30K outlay.

2) Disappointingly, Spotfire Workgroup is a scaled back version of the full Spotfire product. For example, it doesn’t have “information links” that allow users to analyse large volumes of data (via on demand tables). I also understand that Workgroup doesn’t include the mobility features from the “extended results” acquisition” .

I don’t understand why Spotfire, just doesn’t provide the full Enterprise cloud offering via a per user pricing model, starting at 1 licence, like Tableau does with Tableau Server Online.

So I tend to agree, Spotfire has dropped the ball with its new cloud offerings. At the present time, I do tend to think, Tableau Server Online would be the more attractive option for most users.

Cheers, Steve

December 17, 2013 at 10:55 pm

Steve: I suggest you try Tableau Online (it is free) and compare

December 20, 2013 at 1:59 pm

I just took a look at Tableau Online and there’s a gotcha that isn’t readily advertised. Tableau Online doesn’t work unless you already have a desktop license at $1999 / user. You can’t build any reports with the $500 user/year subscription.

Devil’s in the details. Spotfire Cloud Work Group seems comparable at $2,000 / year for a first year.

January 1, 2014 at 2:23 pm

Hi Steve:

thanks for your note – I updated the blogpost above accordingly. It looks like Spotfire Workgroup is cheaper (almost twice cheaper) then Tableau Online and giving to a group of 6 (1 analyst/developer and 5 consumers) more storage (more then twice of storage)…

January 17, 2014 at 1:01 pm

I do know that you can easily get evaluations (of Spotfire Cloud), in addition a way to get an evaluation of the Spotfire Analyst (professional as it was called). Depending on the individual, if they have contacted anyone at Spotfire, or you are a partner, or if they are students or in teaching institutions, those situations can lead to more extended evaluations or depending on the situation free software.

If you do not know anyone at Spotfire to talk to (or don’t want to), or haven’t dropped by the forums to meet the staff, you can do some of this on your own with no contact, and It can be kicked off via downloading a 30 day trial of Spotfire Cloud Workgroup.

https://spotfire.cloud.tibco.com/tsc/#!/tryspotfire

Once you have created and activated the account (2 minutes or less) if you look in the top right of your cloud workgroup webpage you will see a drop down with YOUR NAME Account, in that dropdown you will see evaluation Downloads. Click and you will find a link to download a trial of analyst, which is the professional client.

March 1, 2014 at 2:59 am

[…] https://apandre.wordpress.com/2013/12/14/spotfire-cloud-pricing/ . You can find many providers of DV and BI Cloud Services, including Spotfire Cloud, Tableau Online, GoodData, Microstrategy Cloud, Bime, Yellofin, BellaDati, SpreadsheetWEB etc. […]

March 2, 2014 at 5:17 am

[…] https://apandre.wordpress.com/2013/12/14/spotfire-cloud-pricing/ . My opinions can be different from Guest Bloggers. You can find many providers of DV and BI Cloud Services, including Spotfire Cloud, Tableau Online, GoodData, Microstrategy Cloud, Bime, Yellofin, BellaDati, SpreadsheetWEB etc. […]

March 25, 2014 at 3:01 pm

[…] Andrei Pandre also has other blog posts on Spotfire, Spotfire 6 and new Spotfire Cloud Services on his site. TIBCO Spotfire is one of the leading visual analytic solutions in the market […]